BSE Direct is a Web based platform for Individual Investors to participate in Government Security(G-Sec) and Treasury Bill (T-Bill) issued by the Government of India.

Government Security can be long term (Government Bonds or Dated Securities, maturity of one year or more) or short term (Treasury Bill, maturity of less than one year). These securities are risk-free, since they are backed by full faith and credit of the Government of India.

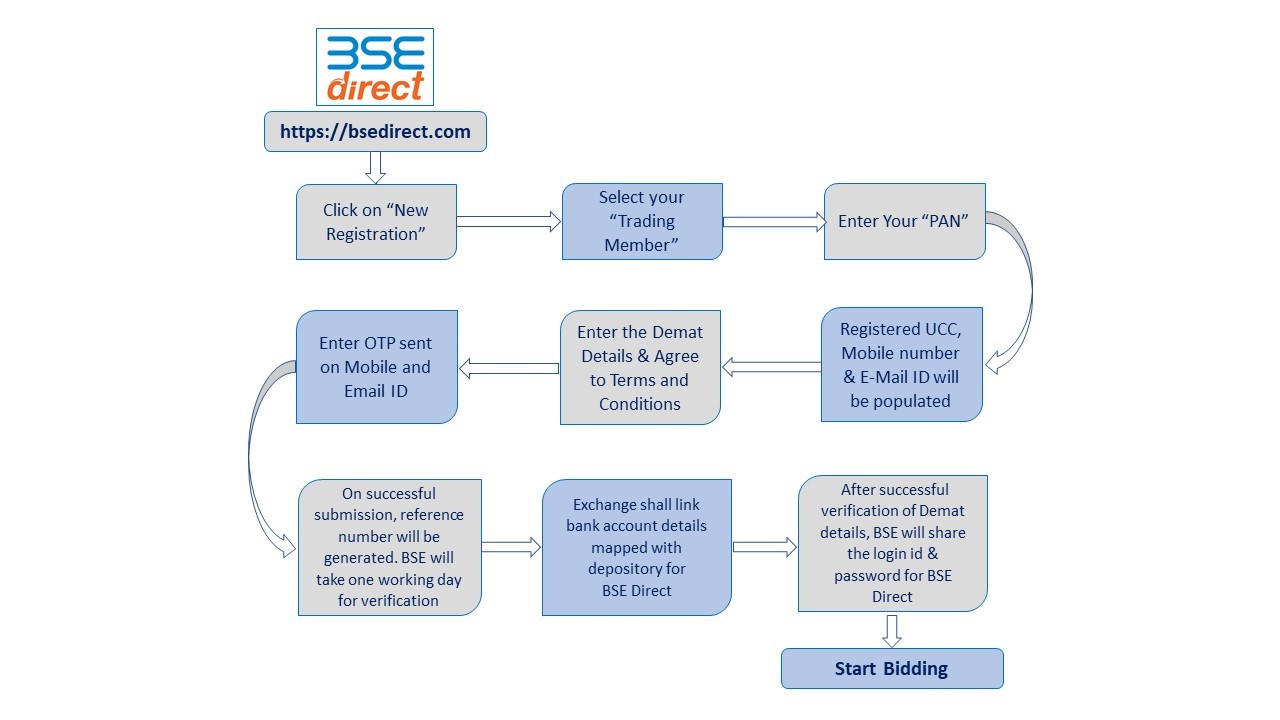

Click below link to go to BSE Direct:

https://www.bsedirect.com

- Login using existing Admin credentials in IBBS

- Go to NCB G-SEC > BSE Direct

- Kindly agree to Terms and Conditions

- To place Bid, Investor selects the security from available list of securities

- Only single bid per security is permitted

- Investor will have to enter quantity in 100 and in multiples thereof (i.e. Rs. 10,000 and in multiples thereof)

- After successful submission of Bid, amount that needs to be transferred will be displayed on the screen

- Investor has to add ICCL as payee in his/her Bank and make the payment

- After successful allocation in auction, security will be credited in your Demat account

- Excess money if any will be credited back to the same bank account

- Investor can transfer funds via NEFT/RTGS to following Account of Exchange Clearing Corporation (ICCL)

Beneficiary Account Number ICGS Bank Name ICICI BANK LTD. Beneficiary Name INDIAN CLEARING CORPORATION LTD. IFSC CODE ICIC0000104 Modes of Transfer NEFT / RTGS Branch Location Lower Parel, Mumbai Remark Investors with accounts in ICICI Bank can use the NEFT / RTGS mode to transfer funds.

OR

Beneficiary Account Number ICCLGS Bank Name YES BANK LTD. Beneficiary Name INDIAN CLEARING CORPORATION LTD. IFSC CODE YESB0CMSNOC Modes of Transfer NEFT / RTGS Branch Location Nariman Point, Mumbai Remark Investors with accounts in YES Bank can use the NEFT / RTGS mode to transfer funds.

As part of the overall strategy of diversifying the investor base for government securities, the Government of India and RBI have been taking various measures to encourage participation of retail investors in G-Sec market including introduction of non-competitive bidding in primary auctions. In continuation of this endeavour, the Union Budget 2016-17 had announced, inter-alia, that RBI will facilitate retail participation in the primary markets through stock exchanges. In line with this announcement and in consultation with SEBI, Specified Stock exchanges are now permitted to act as aggregators/ facilitators for non-competitive bidding for government auctions in G-secs and T-bills.

BSE is pleased to inform all trading members that it has received approval from the Reserve Bank of India (RBI) and Securities Exchange Board of India (SEBI) for acting as facilitator for non-competitive bidding (NCB) under RBI Auction in Government Securities (G-Sec) and Treasury Bills (T-Bills)

BSE will provide an online bidding platform "NCB-GSec" for collecting bids from members on behalf of their clients. This bidding platform is part of the iBBS (Internet-based Book Building System) - Exchange's existing web-based online bidding platform for IPO, Offer for Sale (OFS), Offer to buy (OTB) issues and Sovereign Gold Bond (SGB) issues.

Bidding Platform :- https://ibbs.bseindia.com / NCB-GSec module

Following Government Securities (G-sec) shall for available for non-competitive bidding (NCB) in the primary Auction -

These securities are even tradable in secondary market on the Exchange. For more information on Government securities and the non-competitive bidding process, trading members may kindly refer to the RBI website as follows :-

Frequently Asked Questions (FAQs) :- https://www.rbi.org.in/Scripts/FAQView.aspx?Id=49

RBI circular:

https://www.rbi.org.in/scripts/FS_Notification.aspx?Id=11175&fn=2757&Mode=0

Issue Details

The securities available for non-competitive bidding under G-Sec and T-Bills auction, shall be notified by RBI through notification issued on weekly basis. Exchange shall start collecting bids from retail investors through their broker members before RBI auction date. Subsequent to RBI notification, Exchange shall communicate issue details along with bidding start date & end date via separate circular.

For Operational Guidelines, User manual and File Formats Trading Members can refer the notice no 20180423-42 issued on 23 Apr 2018 by clicking on below mentioned link:

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20180423-42

In case of any queries or clarifications, kindly contact the following teams at below mentioned numbers:-

Presentation on Non-Competitive Bidding

BSE is pleased to inform all trading members that it has received approval from the Reserve Bank of India (RBI) and Securities Exchange Board of India (SEBI) for acting as facilitator for non-competitive bidding (NCB) under RBI Auction in Government Securities (G-Sec) and Treasury Bills (T-Bills)

BSE will provide an online bidding platform "NCB-GSec" for collecting bids from members on behalf of their clients. This bidding platform is part of the iBBS (Internet-based Book Building System) - Exchange's existing web-based online bidding platform for IPO, Offer for Sale (OFS), Offer to buy (OTB) issues and Sovereign Gold Bond (SGB) issues.

Bidding Platform :- https://ibbs.bseindia.com / NCB-GSec module

Following Government Securities (G-sec) shall for available for non-competitive bidding (NCB) in the primary Auction -

- Government Bonds or dated securities: Dated G-Secs are securities which carry a fixed or floating coupon (interest rate) which is paid on the face value, on half-yearly basis. It can be either be new issue or Re-issue.

- Treasury bills: Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. T-Bills are issued in three tenors, namely, 91 days, 182 days and 364 days.

These securities are even tradable in secondary market on the Exchange. For more information on Government securities and the non-competitive bidding process, trading members may kindly refer to the RBI website as follows :-

Frequently Asked Questions (FAQs) :- https://www.rbi.org.in/Scripts/FAQView.aspx?Id=49

RBI circular:

https://www.rbi.org.in/scripts/FS_Notification.aspx?Id=11175&fn=2757&Mode=0

Issue Details

The securities available for non-competitive bidding under G-Sec and T-Bills auction, shall be notified by RBI through notification issued on weekly basis. Exchange shall start collecting bids from retail investors through their broker members before RBI auction date. Subsequent to RBI notification, Exchange shall communicate issue details along with bidding start date & end date via separate circular.

For Operational Guidelines, User manual and File Formats Trading Members can refer the notice no 20180423-42 issued on 23 Apr 2018 by clicking on below mentioned link:

https://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20180423-42

In case of any queries or clarifications, kindly contact the following teams at below mentioned numbers:-

|

Presentation on Non-Competitive Bidding

- What is a government security?

- Who can participate in the Scheme?

- Will non-competitive bidding be allowed in all dated securities & T-bills auctions?

- How can the eligible investors participate in the auctions?

- At what rate will the non-competitive bidders get the allotment?

- If non-competitive bidding amount is more than the amount reserved, how will the ICCL allot the non-competitive bids?

- What is the minimum/ maximum bidding amount?

- In how many days will the investor receive the security?

- How will the securities be issued?

- How will the investor make payment for the security?

1. Q. What is a government security?

A. A government security is a bond issued by Central Government of India with a promise of repayment upon maturity along with periodic coupon or interest payments. These securities are considered low-risk, since they are backed by the full faith and credit of the Government of India and default is unlikely. Government Security can be long term (Government Bonds or Dated Securities, maturity of one year or more) or short term (Treasury Bill, maturity of less than one year).

2. Q. Who can participate in the Scheme?

A. As the focus is on the small investors lacking market expertise, the Scheme will be open to those who do not have current account (CA) or Subsidiary General Ledger (SGL) account with the Reserve Bank of India. Any investor having Demat account, RBI approved investor category, can participate in non-competitive bidding. Participation in the Scheme of non-competitive bidding is open to any person including firms, companies, corporate bodies, institutions, provident funds, trusts and any other entity as prescribed by RBI.

Eligible investors can participate in non-competitive bidding from registered member of the Exchange.

3. Q. Will non-competitive bidding be allowed in all dated securities & T-bills auctions?

A.Yes non-competitive bidding will be allowed in all dated securities and T-bills auctions. The availability of non-competitive bidding facility in an auction will be announced along with the respective press release and the information is made available on Reserve Bank's website.

A sum of 5 percent of the notified amount will be reserved for non-competitive bidding.

4. Q. How can the eligible investors participate in the auctions?

A.Eligible investors can participate through registered brokers. Investors can submit their bids to registered broker, which will be submitted by brokers to Exchange through electronic platform offered by the Exchange.

Registered brokers can submit their pro/clients bid on IBBS electronic platform.

5. Q. At what rate will the non-competitive bidders get the allotment?

A.The allotment to the non-competitive segment will be at the weighted average rate of all allotments to competitive bidders in case of multiple price/yield based auction, and on cut off price in case of uniform price/yield based auction.

6. Q. . If non-competitive bidding amount is more than the amount reserved, how will the ICCL allot the non-competitive bids?

A.In case the aggregate amount bid is more than the reserved amount through non-competitive bidding, allotment would be made on a pro rata basis.

7. Q. What is the minimum/ maximum bidding amount?

A.The minimum amount for bidding will be 100 bonds (Rs. 10,000) and thereafter in multiples of 100 bonds. The maximum amount for a single non-competitive bid should not exceed 2,00,000 bonds (Rs.2,00,00,000) in the auctions of GOI dated securities and T-bills.

8. Q. In how many days will the investor receive the security?

A. The transfer of securities to the clients should be completed within five working days from the date of the auction.

9. Q. How will the securities be issued?

A. RBI will issue securities only in CSGL account of ICCL. The ICCL will in turn credit the securities to the demat account of the investors.

10. Q. How will the investor make payment for the security?

A. The client's broker will have to keep sufficient funds in the ICCL's account on the auction day before 10 a.m. Bids will be checked against available funds after 10 a.m., and bid against insufficient fund balance will be rejected.

RBI Reference link - https://rbi.org.in/scripts/FAQView.aspx?Id=49

- Notices related to Bidding through iBBS (For Trading Memebrs)

- https://beta.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20180419-34

- https://beta.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20180423-42

- https://beta.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20180424-35

- https://beta.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20180425-6

- https://beta.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20181116-47

- https://beta.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20181206-35

- Notices related to BSE Direct

White paper on BSE SME

In this paper, we look at the BSE-SME footprint since 2012 and its growth till date. We also look at the reach of BSE SME, the value creation it has from investors perspectives and the option of capital formation from the SME perspective.

Attention Investors

Leagues/Schemes/Competitions Offered

by Third Party or Group Company

of Stock Broker

BSE is issuing this Investor Alert to warn

investors about leagues/schemes/

competitions etc (hereinafter referred

to as "schemes") offered by third party

or group company /associate of stock

broker, which may involve distribution

of prize monies....

New BSEIndia Android App

Now keep abreast with the happenings of the stock market on your Android Phone.